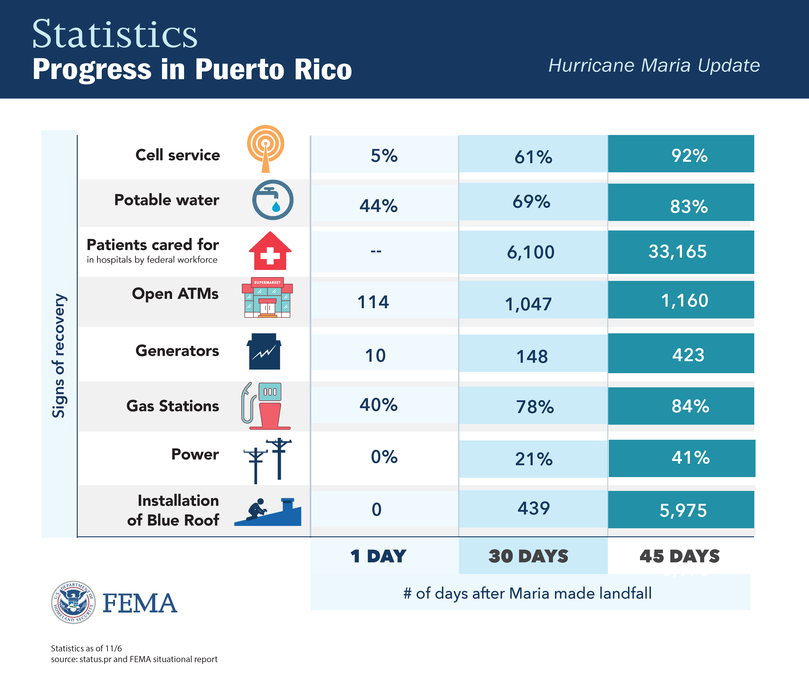

FEMA announced it spent more than $1 billion dollars in hurricane relief for Puerto Rico.

Credit: @fema.gov

History of Puerto Rico’s Economic Downfall

Puerto Rico has been in recent turmoil since Hurricane Irma and Maria hit the island. But truth be told, Puerto Rico has been in an economic crisis for several years now, as they have faced a huge recession. but with 74 billion dollars in debt right now, Puerto Rico is going through an even more publicized crisis.

This U.S. territory had been acquired by America after the Spanish American war, and being a territory may have some economic impact on Puerto Rico. And Dr. Lucia Farriss, instructor of economics at Saint Leo University, agreed that the Puerto Rico being a territory hurt them economically.

“While it created an opportunity to ‘enjoy’ greater economic ties to the U.S., it also created a culture of dependency on generous U.S. social welfare programs,” said Farriss.

She also listed many other factors that contributed to Puerto Rico’s large debt.

“PR’s large debt is a combination of factors: Changes in U.S. tax policy towards the island, poor economic growth, mismanagement of funds/corruption, and a loss in investor confidence once the issue of debt default became a real possibility. PR’s economic driver has historically been via generous tax incentives given to U.S. corporations that operate on the island,” said Farriss.

Speaking of large tax incentives, Puerto Rico’s economy was booming once before because of the large tax incentive. Farriss mentioned some of these tax breaks. In fact, according to Tax Foundation, there were generous incentives for U.S. corporations to locate subsidiaries in this territory because Puerto Rican law “allowed a subsidiary more the 80% owned by a foreign entity to deduct 100% of the dividends paid to its parent,” according to the Tax Foundation.

Farriss also pointed out the tax incentives in the 936 section of the tax code, which were established in 1973, in which U.S. corporations were granted a tax exemptions from income generated in these subsidiaries. However, according to the Tax Foundation, Clinton signed a legislation in 1996 that phased out the tax incentives little by little, leaving it fully repealed by 2006.

“Under President Clinton, section 936 was eliminated over a 10-year period (leaving the bubble this incentive had created as a ticking time bomb for PR’s economy if it did not find other ways to attract business). Consequently, once section 936 was abolished, the economy began to shrink,” said Farriss.

To help the Puerto Rico population, the U.S. offered Puerto Rico municipal bonds, which were tripled-taxed exempt, which Farriss mentioned was another contributor to the massive debt that Puerto Rico is struggling to pay back.

“Another problem has been that PR’s bonds are “triple exempt” from taxes (i.e. are not taxed at the federal level, nor by any state or local municipality). This makes them very attractive to investors, and creates an easy way for PR’s politicians to access alternative sources of funding where tax revenues fall short,” said Farriss.

One major amount of debt on the island is owed by PREPA, the power company, because they lost customers. Due to companies leaving due to fewer incentives, the company borrowed billions of dollars from international creditors. In fact, according to the Economist, PREPA is responsible for 9 billion dollars of Puerto Rico’s total debt, as Farriss pointed out.

“As the mismanagement of funds/corruption much can be said about the power company, PREPA. Municipalities and government agencies do not pay for power in PR. There is little oversight and no incentive towards innovation and productive efficiency,” said Farriss.

Puerto Rico is drowning in debt now. However, as mentioned before, they were in recession long before the 74 billion dollar debt number surfaced following the hurricane hits. In fact, Farriss also pointed out as early as 2006, there were reports of major problems.

In fact, in 2006, The Economist reported that: “Half the working-age men in Puerto Rico do not work. Officially, only 46 percent of those who are not pursuing a degree have formal jobs, compared with a United States average of 76 percent.”

To put the numbers into perspective, in 2017 before the hurricanes hit, the unemployment rate for Puerto Rico was 10.1 percent, compared to US’ entire unemployment rate of 4.4 percent, according to the Miami Herald. However, after the storms, the number of unemployment in Puerto Rico have risen, most likely since a little under a month since the Department of Labor reopened more than 10,000 people applied for unemployment benefits.

“This trend of poverty and joblessness continues today, as more and more Puerto Ricans flee the island,” said Farriss.

This economic recession that Puerto Rico faced for several years has led many Puerto Ricans to head to the mainland. The numbers of people leaving Puerto Rico had been about 80,000 annually, as reported by NBC News. However, following the hurricane hits, more people have left due to crisis with little power and shortages on the island. In fact, within two months of Maria hitting, more than 200,000 Puerto Ricans has left Puerto Rico for the mainland, according to NBC News.

Puerto Rico is deep in debt, and speculations are flying of how to solve their economic crisis, especially on the aftermath of the two hurricanes; however, wiping out the debt might not be simple solution. For more information, on Puerto Rico’s state and the solutions of helping Puerto Rico in their crisis, read the following article: Puerto Rico Stuck in $74 Billion in Debt.